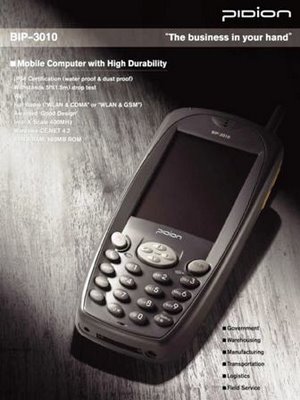

The PIDION BIP-3010 Series Mobility solution. Features high durable design, full radio (CDMA, GSM, WAN), pistol grip option, and more. Image Credit: Daewoo

The PIDION BIP-3010 Series Mobility solution. Features high durable design, full radio (CDMA, GSM, WAN), pistol grip option, and more. Image Credit: DaewooRealizing The Convergence Of Auto ID And Cellphone Technologies

Last week, Motorola agreed to purchase the automatic identification industry leading manufacturer Symbol Technologies.

It was only a matter of time where a major manufacturer and player in the mobility communications world sought to control, influence, and participate in the communication technologies that aid in retail transactions, warehousing, work-in-progress manufacturing, CRM (customer relations management), asset inventory management, supply chain efficiencies, and etc.

The PIDION BM-200 Series Image Credit: Daewoo

The PIDION BM-200 Series Image Credit: DaewooThroughout this last year, manufacturers from "Pacific Rim" manufacturing countries have begun to introduce handheld mobility solutions that incorporate functions that combine CDMA communications (cellphone), MicroSoft CE OS (best for PDA style touchscreen data collectors), PoS applications hardware (on-board printer, card swipe, and etc.), RFID sensors, 2D scanners (to read LCD screens for cellphone transaction verification), and more.

One company effort is marketed here in North America by Daewoo (more commonly known for automobile manufacturing). A major conglomerate business located in South Korea, Daewoo is introducing mobility solutions manufactured under the name of Pidion that combine many of the configurations and functionalities mentioned above.

The PIDION BM-1200 Series Image Credit: Daewoo

The PIDION BM-1200 Series Image Credit: DaewooWith the manufacturing innovation push seen from the Pacific Rim, this announcement now puts the introduction of these platforms into more of a catch up/partner up mode.

This from RIS News -

Motorola to Acquire Symbol Technologies

RIS News and Edgell Communications

Motorola and Symbol Technologies have signed a definitive merger agreement, under which Motorola has agreed to acquire all of the outstanding shares of Symbol for $15 per share in cash. The transaction has a total equity value of approximately $3.9 billion on a fully-diluted basis. As of June 30, 2006, Symbol had approximately $200 million of net cash. Upon completion of the transaction, Symbol will become a wholly owned subsidiary of Motorola. The acquisition is subject to customary regulatory approval and the approval of Symbol's stockholders, and is expected to be completed in late 2006 or early 2007.

In acquiring Symbol, which has the tag line "The Enterprise Mobility Company", Motorola is buying a business that includes wireless technologies, mobile computing, Radio Frequency Identification (RFID), and scanner technology commonly found in retail checkout counters. Symbol brings to Motorola more than 900 patents and thousands of enterprise customers.

Industry analysts weigh in on the acquisition:

Rob Garf, AMR Research: This one will shake up the market a bit. Having Symbol team up with Motorola gives the combined company the ability to tap into the cell phone market, and almost every U.S. consumer has a cell phone. Until now, the role of personal shopping assistant has been somewhat slow to take hold. On day one, this new company will have at its disposal a critical mass of users of this type of technology. Look at some of the retailers who have invested in handhelds - they have had to take on the capital costs, but now can rely on the consumer for the capital costs.

Greg Buzek, IHL Consulting: This acquisition finally brings credibility to the discussion of mobile commerce. Symbol has owned many patents in the area of scan engines and particularly small ones. They have had a history of vigorously defending and litigating those patents in the past to the point that many vendors have been unwilling to work with them. When it comes to mobile commerce, no single vendor has had all the pieces and Symbol had the missing scanner piece. With Motorola purchasing Symbol, mobile commerce and just mobility in all facets will take a strong step forward.

Bud Wagner, CSC Consulting Group: All in all, this acquisition promises to push RFID to the next level as retail and consumer product companies find creative ways to leverage the technology. This could become a powerful tool in optimizing an item's sell-through by having the right product in the right place at the right time.

Eric Austvold, AMR Research: This acquisition will inevitably trigger further consolidation as the likes of Nokia, Ericsson, and others look to snap up someone like Intermec, a Symbol competitor. Standing alone in this market just became unattractive. Motorola benefits from the timing. By acquiring an early RFID pioneer like Symbol, Motorola gets the benefit of Symbol's experience without the pain of initial investment. It also creates an opportunity to grow business from new enterprise customers by aligning with carrier partners like Cingular, AT&T, Verizon, or Sprint to provide new possibilities for mobile computing.

Reference Here>>

To match up with the access this aquisition provides, all the Daewoo PIDION is going to need is to develop a relationship with a cellphone service carrier partner ... or two ... or.

No comments:

Post a Comment